Reopening of Borders Across the Globe

April 1, 2022 – Malaysia’s government announced the reopening of the country’s border to international travellers.

Following this, the land border Malaysia-Singapore was also reopened. All fully-vaccinated travellers will be allowed to entry the country without undergoing quarantine, but will be required to take a RT-PCR test two days before departure and a rapid test (RTK) within 24 hours of arrival.

Hong Kong and Macao passport holders may also enter Malaysia visa-free for up to 30 days. For visa requirements for foreign nationals, see: https://bit.ly/3J3JMQN.

After two years of strict travel, Malaysia has dropped its quarantine requirements for people vaccinated against COVID-19. We can expect some normalcy in the coming months as international flights for both business, tourists and foreign students reopen and resume operations. The road to recovery is positive as inferred by the activities below:

- Malaysia Convention & Exhibition Bureau, the leading business events bureau in the country will be organising a total of 81 business events thus far for the year 2022, and are expecting around 113,700 delegates to Malaysia, contributing to a total of RM834 million in estimated economic impact.

- Malaysia closed a deal with Emirates Airlines to bring tourists from 130 international locations.

- Education Malaysia Global Services is facilitating international students to pursue higher education in Malaysia as it was also reported that there was an increase in PhD applications from international students in the past 24 months, reaching 11,661 in 2021.

Additional information on borders across the world:

- From 16 May, passengers flying in the EU will no longer need to wear masks in airports or aboard flights, though some countries have chosen still require masks. Check the rules before you fly here.

- Austria, Greece, Switzerland, Bulgaria, Croatia, Lithuania, Sweden, Serbia, Slovenia and Slovakia no longer have any Covid-19 travel restrictions for visitors.

- Belgium: Visitors from outside the EU no longer need to show any Covid-19 paperwork to enter.

- Italy: Its ‘state of emergency’ situation has dropped but have extended travel restrictions until 31 May.

- Spain and mainland Portugal: Masks are no longer mandatory, except on public transport.

- Japan: Border restrictions in June will be relaxed further where there are no Covid-19 arrival tests for people from low-risk areas.

- Singapore: Borders have already opened and restrictions are lifted.

- Philippines: The ease in border restrictions allows fully vaccinated international travellers to enter.

With the borders reopening, Mega Fortris also has plans in the pipeline to revisit old friends and business partners around the globe.

Supply Chains Flare Up Again, Endangering Global Recovery

Despite some positive predictions of the supply chain’s recovery, supply chains are getting tangled across globe. From China to Denmark, this new situation is sparking re-examinations of things as macro as globalization itself and micro as trucking efficiency around ports.

As for the big picture, the intertwined world economy took decades to stitch together and will take years to play out, however it evolves. In the meantime, economists are squinting to see the more granular, short-term shifts that the pandemic and Russia’s war in Ukraine are forcing on consumption, investment, production and trade.

Some observers say now is a good time to focus on different metrics than traditional measures of employment, prices and gross domestic product.

“The way we look at the global economy needs to change,” said Steven Barrow, a currency strategist at Standard Bank. “No longer should we look at growth, inflation and monetary policy through the lens of demand. Instead, it is supply that’s key.”

Before the pandemic, the supply of goods and services was what economists would generally call “elastic” — flexing easily to match demand. “But now supply has turned from being elastic to inelastic, meaning that the response to changes in demand are far less,” Barrow said in a note.

With that in mind, there are a few unorthodox supply-side scopes to observe, with one such as below:

- Heat Maps

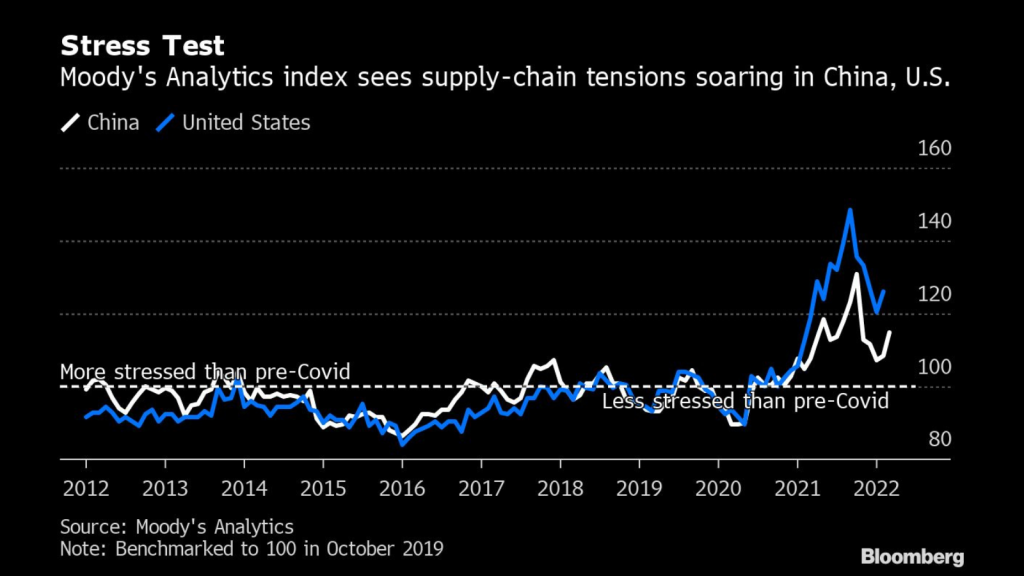

Many economists, including the team at Bloomberg, have developed indexes or colourful heat maps to show the degree of stress on supply lines. In a research note last week, BNP Paribas SA analysts released their latest tracker and it showed some April indicators flashing orange and yellow.

They look at traditional gauges like delivery times and order-to-inventory ratios, along with alternative numbers like air cargo rates and the number of anchored vessels outside the Port of Los Angeles. “Disruptions are back and here to stay,” they wrote.

A Moody’s Analytics measure shows supply stress in the world’s two biggest economies, the U.S. and China, is still hovering well above the pre-pandemic norm.

“Disruptions stemming from the Ukraine conflict steepened those graph lines in February, but now the cause lies primarily with China’s Covid-related woes, which have forced 15% more ships to wait in waters off the ports of Shanghai than at the same time last year, “said Steve Cochrane, the firm’s Asia-Pacific chief economist. “That’s reversing the improvement that started in the final quarter of 2021,” he added.

China’s Trade with The World Withering

China’s trade with the rest of the world declined in April under the pressure from Covid-19 lockdowns and dropping overseas demand, signalling that the global economy is losing traction as high inflation affects consumer spending.

The pullback in exports that helped power China’s growth is heightening worries over a world economy that is already shaken by the war in Ukraine and rising interest rates in the U.S. and Europe.

Exports:

- In March 2022, China’s export growth rate was 14.7%.

- In April 2022, China’s export growth fell sharply to 3.9%, its weakest level since June 2020 due to the stringent COVID-19 rules badly affected the trade in the country. However, this rate was still slightly above analysts’ forecasts of 3.2%.

Imports:

- In April, imports were stagnant, showing almost no growth due to restricted domestic demand.

The sluggish figures reflect the extent to which the Chinese economy has lost momentum in the face of prolonged lockdowns in some of its major economic hubs.

Shanghai, the world’s largest port, has seen massive disruption since late March as a result of curbs aiming at dealing with the country’s worst outbreak of COVID-19 since the pandemic began more than two years ago.

The Chinese government’s zero-COVID policies have seen factories shut down across the city, as well as major shipping delays at the port.

Transport and logistics networks have been severely impacted, with restrictions hitting delivery of goods around the country and to ports with major global shipping connections.

Chicago-based 3PL and global freight forwarder SEKO Logistics said in a customer advisory that ocean and airport operations in Shanghai are currently operating, with factories running if operating under a closed loop system.

“Ocean terminals are operating as normal but with lower efficiency due to staff shortages,” said SEKO officials. “We have seen an approximate 80% decrease in container pickups from outside the lockdown area due to driver shortages and restrictions. Carriers have announced omit calling at Shanghai and vessel cut-off delays due to traffic restrictions. This will be put additional pressure on the terminal once it opens, and we expect port congestion once the restrictions end. The port of Ningbo is an alternative option but is now being impacted as almost all cargo excluding Zhejiang Province has been diverted to Ningbo as an alternative port to Shanghai. This has caused an increase in rates out of Ningbo as well as an equipment shortage.”

The persistent impact of COVID lockdowns on key markets will have wider reaching impacts leading to equipment scarcity in China, hike up of rates and worsening of the traffic jam on Transpacific.

“The problem will continue to remain after that because there are also labour union disputes in the U.S. waiting in the month of May, which historically always leads to slow down at the west coast ports,” he noted.